Anti Money Laundering

Anti Money Laundering

Applicability:

The law is applicable to all Designated Non-Financial Businesses and Professions and the members of their boards of directors (BOD), management and employees, established and/or operating in the UAE and their respective Financial and Commercial Free Zones, whether they establish or maintain a Business Relationship with a customer, or engage in any of the financial activities and/or transactions, trade, business activities outlined in Articles (2) and (3) of Cabinet Decision No. (10) of 2019 Concerning the Implementing Regulation of Decree Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations.

What is goAML system:

The goAML system is an internationally approved electronic system to collect and analyze financial and non-financial information or data to confront money laundering and combat the financing of terrorism. The goAML system is allied with the Financial Intelligent Unit (FIU) and intends to obligate financial establishments and Designated Non-Financial Businesses and Professions (DNFBPs) to register in this system for the purpose of submitting suspicious transaction reports (STRs) and related requirements. It enables the Financial Intelligence Unit (FIU) in the United Arab Emirates (UAE) with better monitor trends during analyzing reports of suspicious activities and transactions to reduce potential threats at more efficient rate and potency.

Registration:

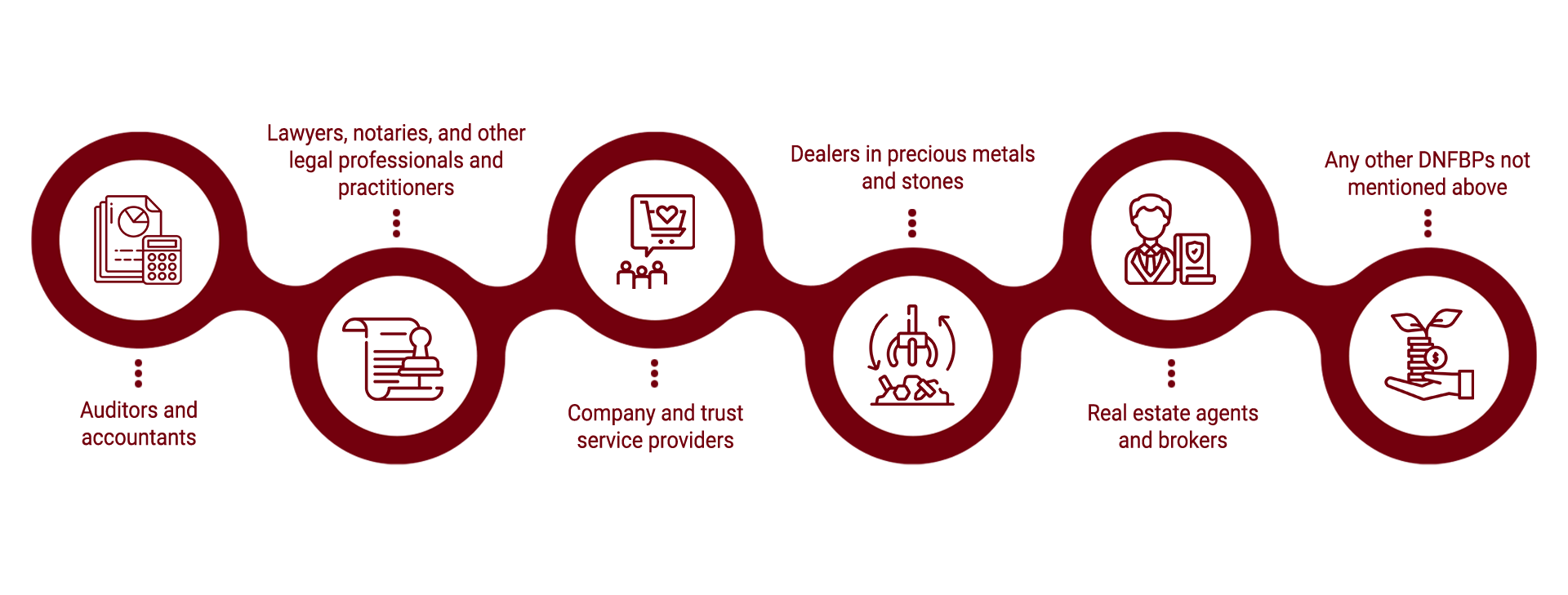

All Designated Non-Financial Businesses and Professions (DNFBPs) must register in the automatic reporting system (goAML) for sanctions lists, to obtain automatically and instantly updated lists of targeted financial sanctions from the United Nations Security Council (UNSC) consolidated sanctions lists and domestic terrorism lists. It is obligatory duty of all DNFBPs under the Federal Decree Law 20 of 2018 and Article 20(2) of Cabinet Decision No. (10) of 2019, to have procedures in place to report Suspicious Transactions to manage anti-money laundering (“AML) and counter terrorist financing (“CFT”).Designated Non-Financial Businesses and Professions (DNFBPs):

Designated Non-financial Businesses and Professions are all natural and legal persons who conduct one or several of the commercial or professional activities defined in the Implementing Regulation of the Decree Law. Anyone who is engaged in the following business activities or trade is considered a DNFBP:

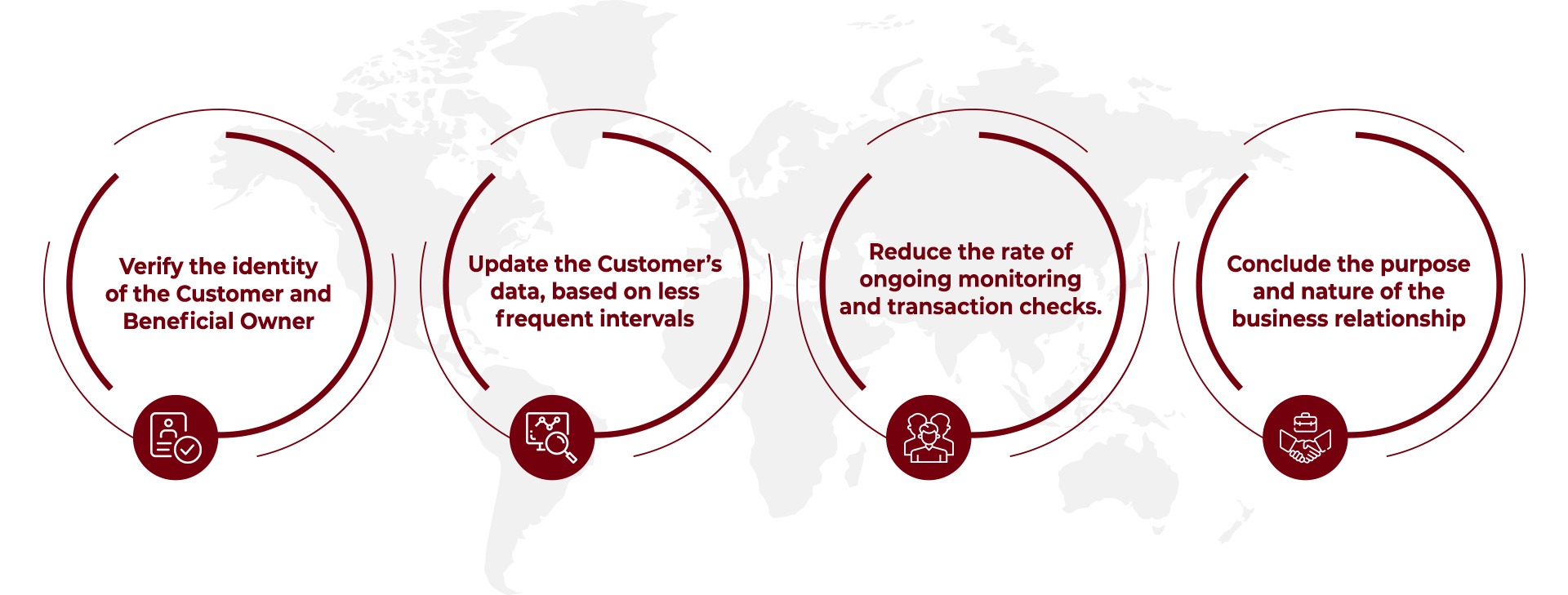

Customer Due Diligence (CDD):

Financial Institutions and DNFBPs are required to undertake the following Customer Due Diligence (CDD) measures;

Record-keeping:

All Designated Non-Financial Businesses and Professions (DNFBPs) are required to maintain all records, documents, data and statistics for all financial transactions and local or international commercial and cash transactions for a period of no less than five years from the date of completion of the transaction or termination of the business relationship with the Customer.Penalties for non-compliance:

The fines and penalties for violations start from AED 50,000 and go up to AED 5 million and could even lead to the revocation of the license or the closure of the facility. Any person or Designated Non-Financial Businesses and Professions (DNFBPs) who commits or attempts to commit any of the acts of the Decree Law will be sentenced to imprisonment for a period not exceeding ten years and to a fine of no less than AED 100,000 and not exceeding AED 5,000,000 AED or either one of these two penalties.How BSA can help you with goAML?

Businesses in the UAE need assistance of AML consultants in Dubai who can guide them in establishing the AML related compliance procedure activities in their organization in line with the applicable rules and regulations. We as Anti Money Laundering (AML) consultants in UAE, can help in designing and maintaining the compliance system expected from the entity to fulfil the DNFBPs related obligations:

Bader Saleh Auditing of Accounts help in developing the Governance structure for AML compliance consisting of policies, procedures, and systems;

Bader Saleh Auditing of Accounts help in developing the Governance structure for AML compliance consisting of policies, procedures, and systems; Help you register in the go AML system.

Help you register in the go AML system. Implement AML/ KYC/ CFT Plan and framework;

Implement AML/ KYC/ CFT Plan and framework; Provide the outsourced compliance function and/or assist in the nominated compliance officer (Anti Money Laundering Reporting Officer – AMLRO) for maintaining the compliance as per AML/ CFT laws;

Provide the outsourced compliance function and/or assist in the nominated compliance officer (Anti Money Laundering Reporting Officer – AMLRO) for maintaining the compliance as per AML/ CFT laws; Develop and review the system for Customer Due Diligence (CDD);

Develop and review the system for Customer Due Diligence (CDD); Develop the system for identifying and reporting suspicious transactions; and

Develop the system for identifying and reporting suspicious transactions; and Advise on the documentation and record-keeping requirements for Anti Money Laundering (AML) Compliance.

Advise on the documentation and record-keeping requirements for Anti Money Laundering (AML) Compliance.

Need the assistance of an AML consultant?

As an AML consultant, we keep our clients updated with the latest AML rules and regulations and asses them in designing the compliance procedures to promote confidence in their operations, identify and report suspicious transactions to prevent any type of risk regarding money laundering, and reduce fraud and financial crimes.

Request a call back.

Frequently Asked Questions

What services are offered by BSA auditing of accounts?

How can I get in touch BSA experts?

Request for Our

Free Consultation

Our Clients