Company Incorporation in DAFZA

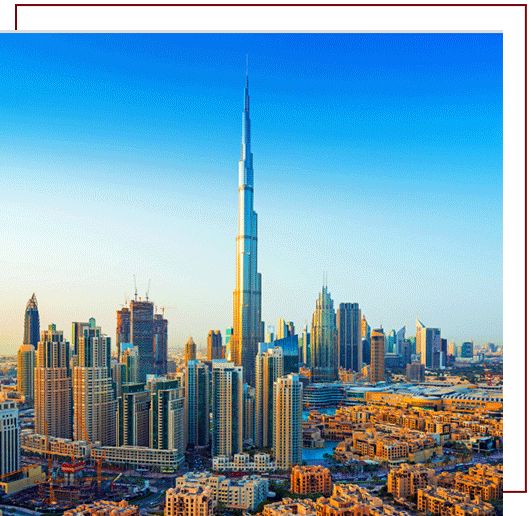

Dubai Airport Freezone (DAFZA) Company Formation & Business Setup Services In Dubai UAE

Get A Quote

DAFZA Company Formation

Setting up your business at Dubai Airport Freezone (DAFZA) means joining one of the fastest growing Free Zones in the UAE. Strategically located adjacent to the Dubai International Airport, businesses in DAFZA leverage unique benefits in market access, tax exemptions, and world-class facilities. DAFZA provides the most attractive incentive packages, connectivity and support to multinational companies from every continent, enabling them to establish their regional offices here in Dubai.

What are the benefits of Company Formation in DAFZA (Dubai Airport Free Zone)?

- The Strategic Location situated next to Dubai International Airport with World class infrastructure provide clients an upper hand to perform business activities effectively and efficiently.

- 24/7 customs services and rapid cargo clearance

- Dedicated logistics centre

- 100% corporate tax exemption

- 100% personal income tax exemption

- 100% import and export tax exemption

- 100% foreign enterprise ownership

- 100% repatriation of capital and profits

- No currency restrictions

- One of the designated zone (Tax-Free as per FTA)

DAFZA offers the following licensing options:

Trade License

A trade license allows the holder to carry out trading activities including import, export, re-export, distribution, and storage of specific products.

Service License

A service license is geared towards service-oriented businesses and enables an entity to provide services specified in the license. Note that obtaining a service license requires consultation with our sales executives to facilitate the selection of the right category.

Request Free Consultation

Call us or submit your questions, comments, or proposal requests.

Industrial License

An industrial license entitles the holder to carry out light manufacturing industrial activities, packaging, and assembling.

General Trading License

A General Trading license allows the holder to trade in general activities including import, export, re-export, store, and distribute.

How can Bader Saleh Auditing help you set up business in the DAFZA Free zone?

- Review all the necessary requirements of your business activities and suggest the best free zone where you can open and incorporate your Company in the UAE.

- Support you in organizing feasibility reports and strategizing your business plan.

- Assist in preparing the company set up an application form which must be submitted to the Free Zone Authority or any other relevant Authority.

- Getting trade name approval, initial approval, and secure approval for your business.

- Attesting the legal documents from the concerned department of the authorities for corporate clients.

- Drafting the Memorandum of Articles (MOA) of the company.

- Provide guidance in the warehouse/s or offices selection.

- Support and guidance for E-channel registration and obtaining the establishment card.

- Assistance for opening your company bank account/s and personal bank account.

- Visa assistance for employees as well as investors/shareholders/management.

- Help in selection of and hiring suitable employees for your newly formed company.

- Proper guidance while appointing an auditor, as having an auditor is a compliance requirement for free zone companies in UAE.

- VAT compliance and advisory support for VAT Registration, VAT implementation, VAT return filing and all other VAT-related matters as being FTA approved Tax Agents.

- Provisions for Accounting & Bookkeeping Services.

- To add or remove existing shareholder or Director

- To change the trade name of the company.

- To produce additional company documentation (Certificate of Incumbency, Certificate of Good Standing, etc.)

- To increase or decrease your company’s share capital.

- Hence, we support from company incorporation to company liquidation.

Companies operating at Dubai Airport Freezone follow the freezone’s Registration Regulations. The Dubai Airport Freezone offers two different company formation types: Free Zone Company (FZCO) or Branch of an existing company.

Since DAFZA Free zone is treated as a designated zone through the Cabinet Decision No. 59 of 2017 on Designated Zone for the purposes of the Federal Decree-Law No. 8 of 2017 on Value Added Tax (VAT) shall be treated being outside the state. The applicability of VAT on the transfer of goods in designated zone will apply only if the place of supply is considered to be inside the state.

Similarly, Excise Duty will be applicable on Excise Goods from DAFZA Free zone when they are released from DAFZA Free zone (designated zone). Designated Zones also has to maintain the controls and conditions of transfer of goods as specified in the Executive Regulation for Excise Tax law.

At Bader Saleh Auditing of Accounts, we provide licensing support for starting a business in Dubai, along with the all-inclusive ministrations necessary to set up operations for global businesses and foreign investment.

We are Approved Auditors in DAFZA Free Zone and registered agents to assist clients to set up their businesses in DAFZA and all over the UAE. We handle the complete Free zone company formation process with strategic recommendations and negotiations with local stakeholders along with documentation formalities.

DAFZA Free Zone License Renewal/ Liquidation

We will assist you in Audit Report preparation as being Approved Auditors in DAFZA Free Zone, hassle-free and cost-effective license renewal/company liquidation solution, Visa Renewal, and all other PRO Services.

Requirements for Termination of Company in DAFZA Free Zone

- Application for Company Closure & Board Resolution (We will prepare Company Termination Application Form & Board Resolution)

- Clearances from Post Office, DAFZA Free Zone Facilities, DAFZA Free Zone Visa Department & DAFZA Free Zone Customs

- Issuance of Liquidation Certificate as being Approved Auditors and Liquidators in DAFZA Free Zone

For other Free Zone Company Formation in Dubai please click the below links;

For RAKICC Offshore Company Formation click the below links;

Fly High in the DAFZA Sky!

BSA is offering you the wings you need to trek the peak of the market. BSA helps in making your dreams come true starting from the business auditing and reviewing the requirements necessary for DAFZA registration to Drafting the MOA, approval of trade name, and guidance in selecting warehouse/ office, just to help you in achieving your goals.

Request a call back.

Frequently Asked Questions

BSA is a full-service independent Audit, Accounting and Management Consultancy firm, providing the best in class services for Accounting and Bookkeeping, VAT/ Tax Consultancy, Audit and Assurance, Risk and Compliance advisory, CFO Services, Odoo ERP solutions, HR and Outsourcing services along with effective Business Consulting, Company Incorporation and Advisory services.

You can also email us at info@bsauditing.com or call us at +971 4 570 7357

Our Clients