Why VAT in UAE?

Value Added Tax (VAT) was introduced in the UAE on 1 January 2018. VAT (VAT consultancy services) will provide the UAE with a new source of income which will be continued to be utilized to provide high-quality public services.

The introduction of taxes in the UAE is part of a GCC-wide initiative to diversify regional economies. The GCC member states have agreed to sign unified framework agreements for the implementation of VAT and Excise taxes. Member states will also implement their own domestic legislation that will govern the introduction of these taxes.

The UAE’s citizens and residents enjoy exceptional public services, such as healthcare, roads, education, parks, social services and waste management. The full cost of these services is paid for by the government. The introduction of VAT consultancy and Excise taxes will help the UAE diversify sources of revenue so that government departments can continue to deliver excellent public services and ensure a high quality of life for coming generations.

In addition, taxation allows governments to correct certain behaviors that are detrimental to society and which cannot be left to the market to regulate. Excise taxes on products that are harmful to human health are a good example of this.

The implication of VAT on businesses

Businesses will be responsible for carefully documenting their business income, costs and associated VAT charges.

Registered businesses and traders will charge VAT to all of their customers at the prevailing rate and incur VAT on goods/services that they buy from suppliers. The difference between these sums is reclaimed or paid to the government.

VAT-registered businesses generally

- Must charge VAT on taxable goods or services they supply

- May reclaim any VAT they have paid on business-related goods or services

- May reclaim any VAT they have paid on business-related goods or services

VAT-registered businesses must report the amount of VAT they have charged and the amount of VAT they have paid to the government on a regular basis. It will be a formal submission and reporting will be done online.

If they have charged more VAT than they have paid, they have to pay the difference to the government. If they have paid more VAT than they have charged, they can reclaim the difference.

Why is “VAT Advisory Services” important in the UAE?

UAE businesses are facing quiet a number of challenges while implementing VAT in their business stream to ensure that they are VAT compliant. As VAT is a newly adopted concept in the region, it requires advice from qualified and experienced Tax professionals, to support the businesses especially, while complying in the initial stages of this transition. Tax Experts at Bader Saleh Auditing of Accounts have relevant industry-specific experience in taxation complying with international standards.

Importance of VAT Registration in Dubai, UAE

Why is it important for businesses in Dubai & UAE to register for VAT:

- It boosts company prestige

- Keeps your business safe from penalties

- One may claim for VAT refunds

- It helps to grab a mass market

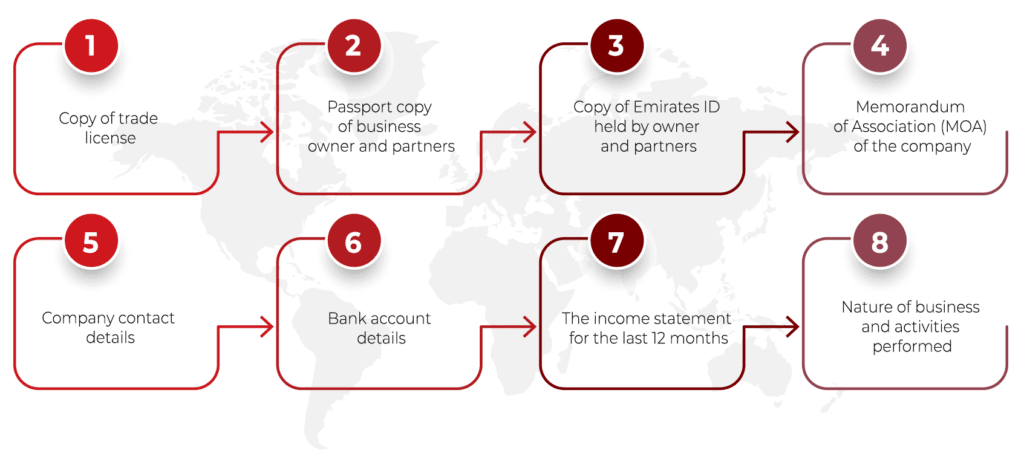

The Requirements For VAT Registration In Dubai UAE

BADER SALEH VAT consultancy & Advisory Services In Dubai UAE?

- We provide timely, precise & cost-effective support.

- Analysis of VAT consultancy services impacts various aspects of the business.

- Articulate solutions and prepare recommendations through meetings and discussions.

- Queries or clarifications raised through telephone/email are answered or advised through telephone/email itself.

- Handle industry-specific issues with precise guidance to comply with the UAE VAT law.

- Advisory Services with regard to Customs clearance as well as designated zone related issues.

VAT Registration Process in UAE

To register for VAT in Dubai UAE, one must fill the VAT Registration form online and submit the essential documents required along with the form in order to attain VAT Number. You can register online through www.tax.gov.ae and get your TRN number, only after the submitted documents are reviewed and approved by the FTA. The documents & steps you will require for VAT registration are as follows.

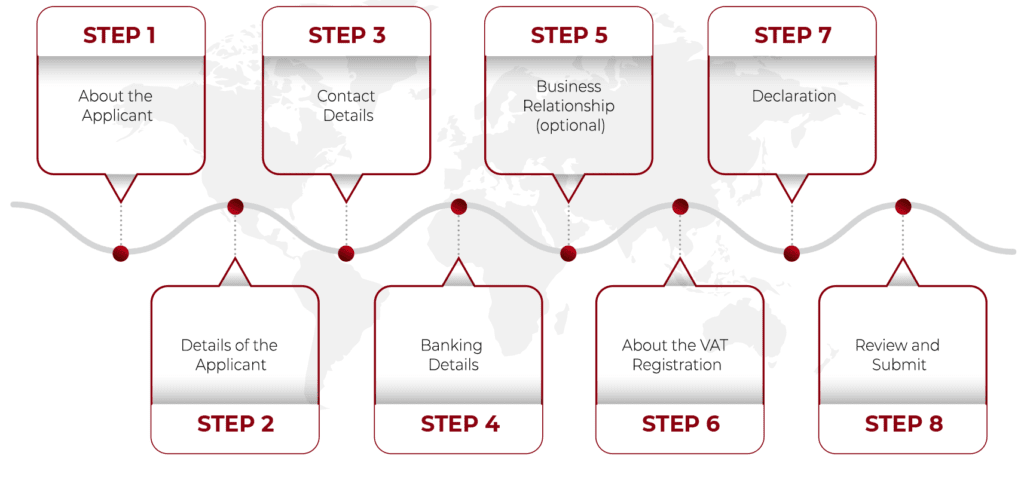

The steps for VAT registration online In Dubai

To register for VAT in Dubai UAE, one must fill the VAT Registration form online and submit the essential documents required along with the form in order to attain VAT Number. You can register online through www.tax.gov.ae and get your TRN number, only after the submitted documents are reviewed and approved by the FTA. The documents & steps you will require for VAT registration are as follows.

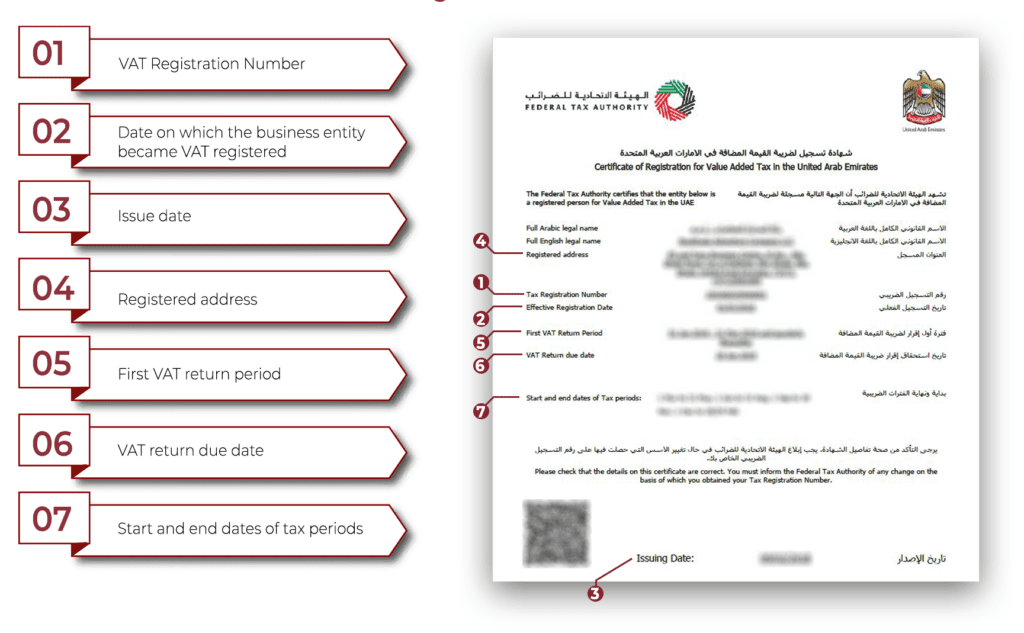

What is VAT Certificate?

VAT Certificate is a document that serves as an official confirmation that a business entity is registered under the VAT law for the purpose of tax collection at every step of product development. This certificate is the final step after the VAT registration process, and is issued by the Ministry of Finance and has got a unique number for different business entities registered. VAT certification certificate UAE is a proof of business entities being registered under the UAE Tax Law and assures that the business entity is known by the Government of Emirates. Let’s have a look at the contents of the VAT certificate.

Contents of VAT Certificate

Why choose BADER SALEH AUDITING OF ACCOUNTS for VAT Advisory Services?

Bader Saleh Auditing of Accounts assists the clients efficiently to manage their VAT transactions by complying with VAT laws and advising on transactions.

Our VAT consultancy services provider ensures that the businesses comply with the rules and regulations.

Our services are designed to comply with your business needs to cater you.

Our VAT consultancy experts are enriched with international experience in taxation in various industries.

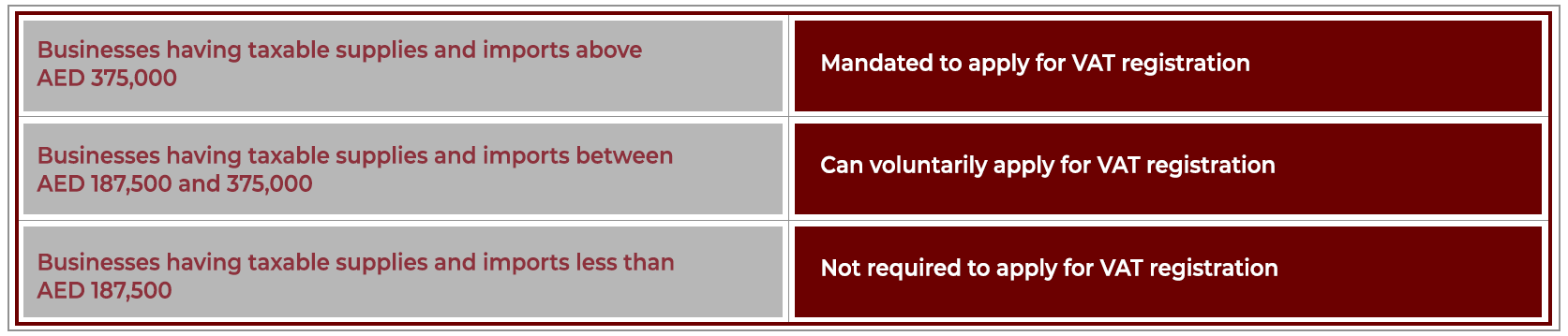

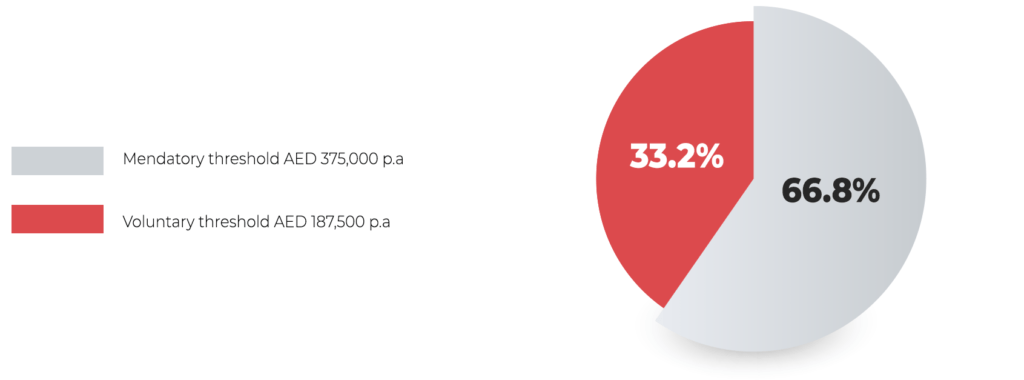

Criteria for registering for VAT

Request a call back.

Taxation requires a proficient mindset and a dedicated and hardworking individual who should always be updated with every change in taxation policies after every financial year. BSA’s tax consultants work day and night to meet our client’s standards.

Request a call back.

Frequently Asked Questions

What services are offered by BSA auditing of accounts?

How can I get in touch BSA experts?

Request for Our

Free Consultation

Our Clients