Accounting & Bookkeeping

Home » Accounting & Bookkeeping

Accounting & Bookkeeping

Accounting is systematic and comprehensive recording of a financial transaction relating to any business through a process of analyzing, summarizing and reporting these transactions. Accounting is also the means by which information about an enterprise is communicated and, thus, is sometimes called the language of business. Integrity of financial reporting is important because of the reliance that is placed on financial information by users both outside and inside the reporting organization. Our team at Bader Saleh Auditing of Accounts has deep industry knowledge and experience in delivering solutions across business and organization.

Importance of Accounting in Business Organization

A business organization involves an individual or a group of people who collaborate to achieve certain commercial goals.

Planning Budget

A budget is an estimation of revenue and expenses over a specified future period and is usually compiled and re-evaluated on a periodic basis. Budgeting is also considered a core factor in every business. Planning budgets help business to make strategies, defining objectives, controlling income and expenditure, directing both capital and revenue resources in a profitable way and discloses weaknesses. To make a budget you need various previous records. For these documents to be available, they must be very well maintained through accounting since they are the basis of planning and making budgets.

Banks and Lenders

To get any loan from the financial institution, you must be able to present your financial status in acceptable order. So, you need to have proper accounting system to present various books of records such as profits recorded, assets and liabilities, taxes paid among others. Financial institutions will scrutinize them carefully before landing to a decision of awarding loan.

Keeping Records

Every business needs to keep records and act upon them in order to run smoothly and monitor the progress. Accounting plays a vital role in keeping records. All records are collected, organized, and interpreted in order to be communicated to the end users, therefore helping in making an economically viable decision which will lead to the positive productivity of the business organization.

Decision Making

To take any important decision in any organization you need data, records, reports, analysis, accurate information about assets, debts, liabilities, profits etc. and that is why Accounting is important. Without proper accounting in a business organization, the executives can’t make a sound decision since they will be operating in blindness hence making it impossible to achieve organization objectives.

Information to Investors

Financial statements and accounts are used to represent the organization to the stakeholders such as debtors, creditors, government, and investors, customers and employees. Many investors will run away from your organization if you lack financial records and accounts to presents so as they can know the business progress.

Reporting Profits

The key objective of any business is to make profits. Every business, being a small or large organization, must maintain accounting system so as they can ascertain what they are making on their business transactions. This also enables interested parties to make the decision on the progress of the business productivity.

Cash Flow Management

Cash flow management for business can be summarized as the process of monitoring, analyzing, and optimizing the net amount of cash receipts minus cash expenses. Net cash flow is an important measure of financial health for any business. Proper accounting systems will take care of working capital and any other cash requirements within the business organization.

How BADER SALEH engages in providing Accounting Services

Weekly Visit:

Our representative will be visiting your office on a weekly basis and update transactions. This will cover entry of all purchases, sales, receipts, payments and other business transactions including recognition of transactions on accrual basis. The system generated Management Information System (MIS) reports will be generated and discussed then and there with the management. Monthly reports will be prepared and issued to the management at the end of every month.

Monthly Visit:

If the number of business transactions in the company is comparatively less, monthly one or two visits will be sufficient to complete updating of books of account. Our representative will be visiting the clients’ office at the end of every month/beginning of the next month and update the transactions. This will cover entry of all purchases, sales, receipts, payments and other business transactions including recognition of transactions on accrual basis. The system generated Management Information System (MIS) reports will be prepared and discussed with the management by our executive. Further quarterly reports (in-house financial statements) will be prepared and issued to the management at the end of every quarter.

Why BADER SALEH

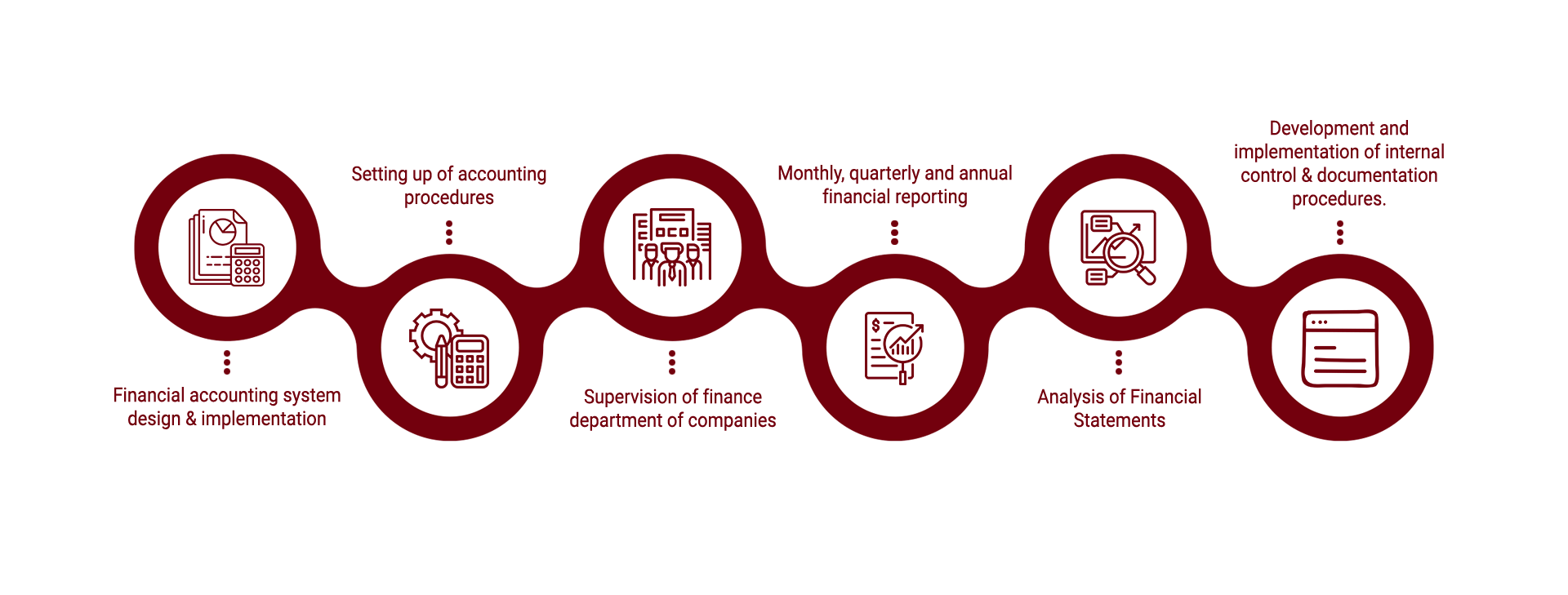

As per the UAE Commercial Company Law 2015 and UAE VAT Law, it is mandatory to maintain proper books of account for at least five years following the International Financial Reporting Standards (IFRS). Bader Saleh Auditing of Accounts offer a wide spectrum of accounting services that answers to the financial needs of any business in the global market. We are engaged in providing the following services are;

We are engaged in providing the following services are;

Let’s get your finances on track!

Whether it is keeping an eye on financial accounts or keeping the information of our clients confidential. Our team of skilled analysts observes the past and present records of our clients and predicts the future.

Request a call back:

Why BADER SALEH

As per the UAE Commercial Company Law 2015 and UAE VAT Law, it is mandatory to maintain proper books of account for at least five years following the International Financial Reporting Standards (IFRS). Bader Saleh Auditing of Accounts offer a wide spectrum of accounting services that answers to the financial needs of any business in the global market. We are engaged in providing the following services are;

Frequently Asked Questions

What services are offered by BSA auditing of accounts?

How can I get in touch BSA experts?

Request for Our

Free Consultation

Our Clients